Determining what you will pay for Medicare is often a confusing and frustrating process. Read on for some clarity…

Medicare Part A covers Hospital services. Most people will pay no premium for Part A because they are eligible based on their, or their spouse’s, work record – meaning they or their spouse has worked 10 years in the United States, earned the minimum amount required in each quarter and paid their taxes. For those people that do not qualify for premium-free Part A, the 2019 Medicare Part A premium is $437 per month, per person, who is on Medicare.

Medicare Part B covers Medical services. Premiums for Part B are income-sensitive, and the limits can change slightly from year to year. For lower-income Medicare beneficiaries whose income falls below 135% of the Federal Poverty Limit (In Arizona, $1406 per month for an individual or $1903 for a couple), Medicare Part B premiums are paid by Medicaid under one of three Medicare Cost Saving

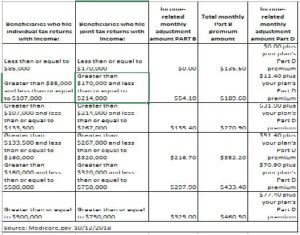

Programs. For Medicare beneficiaries whose modified adjusted gross income is higher than those limits but less than $85,000 per year for an individual or $170,000 for a couple filing jointly, each person on Medicare would pay $135.50 for Part B. If income is higher than that, an Income Related Month Adjustment Amount (IRMAA) surcharge will be assessed on the Part B premiums of each person on Medicare. It is important to note that if you are subject to IRMAA, that you will also have a surcharge on your Part D (prescription drug plan) premium as well. Social Security looks back two years to determine your IRMAA. Meaning, your 2019 IRMAA determination is based on your 2017 tax filing. (See chart)

Now you may say, “Wait a minute, I have retired, and my income is significantly less than what it was two years ago. Can I get that adjusted?” The answer is… most likely yes. If you had a life changing event such as marriage, divorce, death of your spouse, work stoppage, work reduction, loss of income-producing property, loss of pension income, or a one-time employer settlement payment,

you can file an SSA-44 form to appeal the IRMMA surcharge based on what your estimated modified adjusted gross income is projected to be in 2019. Great News!

At this point, you might be thinking, “Okay, but how do I pay these premiums?

If you are receiving a monthly Social Security payment (survivor’s, disability, retirement, etc.), the premiums for Part B will come directly out of your payment. If you are not receiving Social Security payments, you will receive a quarterly bill for your Medicare premiums and any applicable IRMAA surcharges. Medicare invoices can be very confusing especially if you are subject to an IRMAA surcharge sometimes the surcharge comes on separate invoices leaving you unsure of what you are paying for. If you receive a confusing invoice (or invoices), flip it over and on the back will be information on who to contact if you have questions. You will have options on how to pay the balance; i.e., online bank bill-pay, credit card (Visa, Mastercard, American Express, or Discover), or you can mail a check. You can also set up for Medicare to take the premiums out of a checking or savings account each month by filling out a Medicare Easy Pay form and sending it along with a voided check to the address on the form. It will take 6-8 weeks from the time the form is received for setup of the electronic bank draft so keep paying your invoices until you receive confirmation that your premiums will be automatically drafted each month. Be sure to pay monthly until you start drawing Social Security; your payments then automatically begin coming out of those

payments, regardless of whether you were paying quarterly invoices or having the premiums drafted from your bank account each month.

As always, we are here to help so don’t hesitate to As always, we are here to help so don’t hesitate to reach out to us!